“With every success the company has had since Steve [Jobs]’s death, there’s always a moment in the midst of my excitement when I think, I wish Steve could be here for this. It’s impossible not to have the conversation with him in my head that I wish I could be having in real life. More than that, I believe that if Steve were still alive, we would have combined our companies, or at least discussed the possibility very seriously.”

Those words were written by Disney’s then-exiting CEO Bob Iger in his 2019 memoir, The Ride of a Lifetime. A reflection on Iger’s once-unthinkable proposal to rebuild Disney’s then-burned bridge to Pixar by purchasing the still-young animation studio outright, Iger discusses his deep friendship with Apple / Pixar founder Steve Jobs, how much Disney learned from Pixar’s culture and creativity, and – most importantly – how, to Iger’s thinking, Disney and Apple might’ve merged if Steve Jobs hadn’t died in 2011.

When The Ride of a Lifetime was published, the thought sounded absolutely impossible – like a glimpse into some unimaginable multiverse. But in 2023, entertainment industry insiders and entertainment publications began to churn anew with the idea that one day, Disney·Apple might not be a fever dream after all, but a serious potential path forward…

With that, it’s worth throwing our hat in the ring of a thousand think-pieces that surround the “improbable potential” of a future where Disney and Apple are one, examining what makes this so unlikely, yet so possible…

THE CASE FOR “DISNEY·APPLE”

1. Disney’s a big fish… but in a small pond

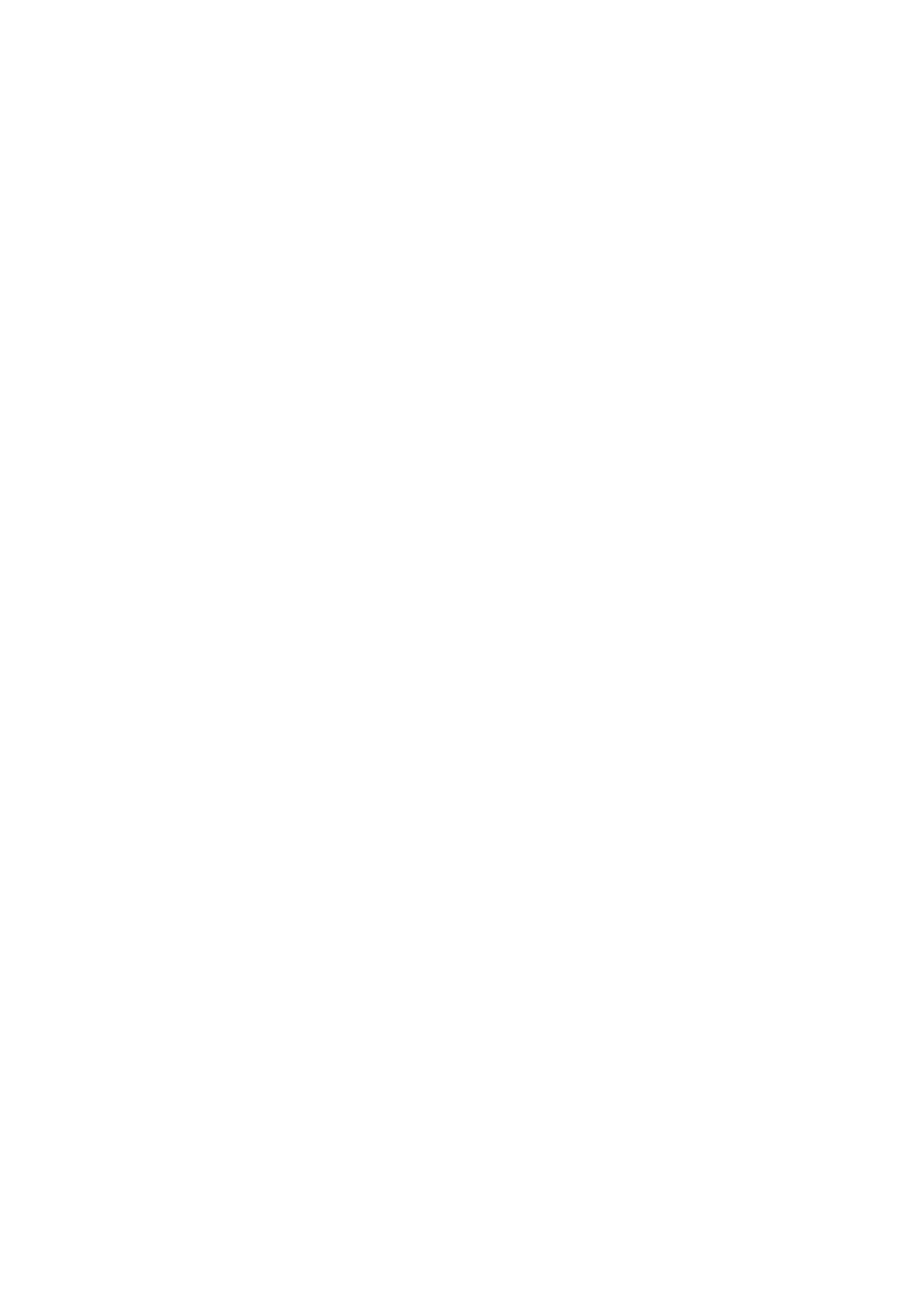

At press time, The Walt Disney Company had a market capitalization (a measure of the value of all stock, representing Wall Street’s determined “worth” of the company and its assets) of $175 billion. Even though it’s less than half what Disney was valued at at its peak in March 2021 (over $350 billion), and even though that values the entire Walt Disney Company slightly lower than Netflix (with a $209 billion valuation), $175 billion is still a whole lot of money. There’s no question that Disney is the reigning king of entertainment companies.

But Disney is a big fish in the relatively small pond of “entertainment.” Comparatively, “tech” is less a pond and more a vast, all-consuming ocean. And that ocean is reigned over by the largest company in the world, Apple, whose current market cap is $2.95 trillion. That’s $2,950,000,000,000; ten Bill Gates, 13 Disneys, or 1,645 Kim Kardashians.

To put that number into perspective, Apple has famously faced a major cash problem… but it’s a very different problem than you and I face. Basically, Apple has too much cash. In 2022, Apple reportedly had $202.6 billion in cash and investments, which the company promised to start investing or hanging out to shareholders. In effect, Apple could buy Disney without even taking out a loan.

Of course, many industry insiders suggest that if Disney and Apple were to “merge,” what it would really look like is Apple buying a controlling stock in Disney, effectively overtaking the Mouse House’s governance without officially buying out or acquiring it. This situation would be something of a “hostile takeover” without the hostility, given that any stock buy of that size would be orchestrated between Disney and Apple – something Iger and Apple’s CEO Tim Cook would need to carefully manage with their respective Boards, creating a very new, very unique financial relationship.

And speaking of the bigness of tech versus entertainment, let’s remember…

2. We live in the era of acquisition

Anyone who’s followed the entertainment industry at all in the last decade will tell you that we are living in the midst of the “Content Wars.” Hundreds of billions of dollars have been exchanged in the last few years, all the name of bolstering the intellectual property portfolios of increasingly-massive entertainment companies. (Iger’s acquisitions of Pixar, Marvel, and Lucasfilm in 2007, 2009, and 2012 respectively are seen today as almost-prophetic, industry-changing moves that set the pace for today’s entertainment industry.)

But if you’re still focused on Disney owning Pixar, or Universal owning DreamWorks, you’re thinking too small. Consider the “Big Six” movie studios that defined entertainment for the last century… Nearly all have been folded into the “Content” collections of massive multinationals.

The already-enormous combination of NBC and Universal (called, of course, NBCUniversal) was acquired by cable and internet giant Comcast; Paramount is just one asset within the mega-merger of ViacomCBS; MGM was purchased in full by Amazon; Warner Bros. belonged for a time to telecommunications giant AT&T before being sold to Discovery Inc., reformed into Warner Bros. Discovery; and 20th Century Fox is no more, absorbed into Disney by way of a $72 billion buy-out in 2019.

Disney is one-of-a-kind in the entertainment industry in that it has never been a subsidiary of a larger corporation. But frankly, it’s rare for an entertainment company to be standalone venture. If any entertainment company could press forward as its own, independent multinational, then surely it’s Disney with its very diverse portfolio of businesses…

But it’s also worth recognizing that Disney’s name, studios, partners, and brand make for a very appealing package that only a tech company could afford. And of them, only Apple really makes the most sense. Why? We’ll dive into that on the next page.