THE CASE AGAINST “DISNEY·APPLE”

1. It would be huge. Maybe, too huge.

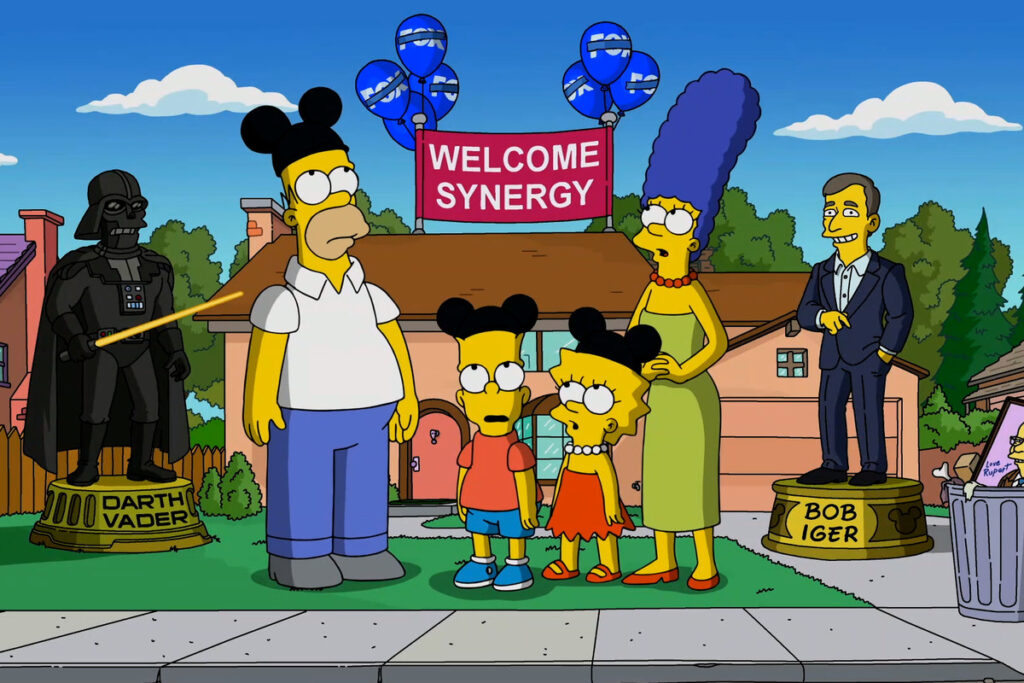

In the United States, the Federal Trade Commission and the U.S. Department of Justice are tasked with ensuring that the “free market” doesn’t get so free that monopolies form. Before Discovery Inc. could buy Warner Bros., or before Disney could buy 20th Century Fox, both acquisitions needed to win the green light from regulators. (That’s why, for example, Disney could acquire most of 20th Century-Fox, but not the terrestrial Fox television assets. Owning ABC and Fox could’ve given Disney anti-competitive control and leverage over advertisers, cable companies, and customers.)

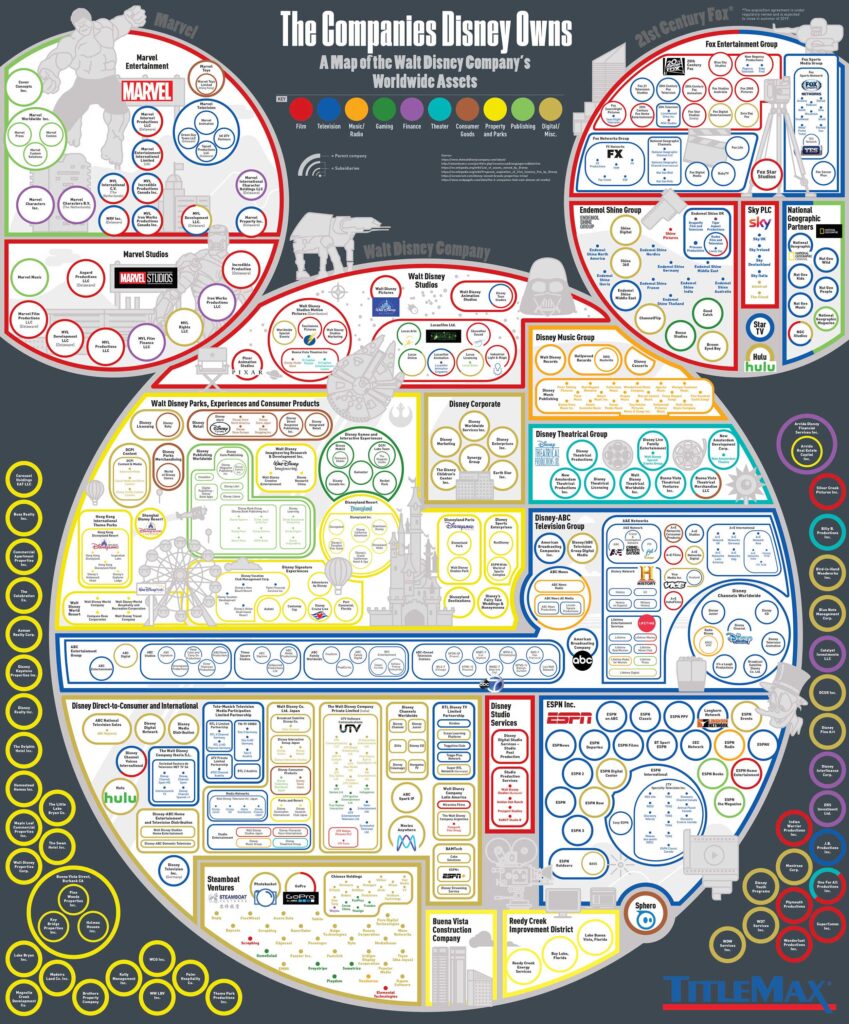

As the often-shared and almost comedic graphic above suggests, Disney alone is really less like one large company and more like two dozen medium-large companies all entangled and intertwined. It’s already a behemoth. So to nest it under an umbrella corporation alongside Apple – a massive corporation in its own right – would create a gargantuan mega-conglomerate so unwieldy, it’s incredibly unlikely that one executive team or Board could ever reasonably be expected to oversee it.

Many experts on antitrust regulation suggest that the government would block a sale of Disney to Apple on the grounds that both are major players in their respective industries, and that the resulting mega-company would simply have too much power in media. But it’s worth remembering that – like all government entities – the FTC and DOJ are made up of people who can be swayed by lobbyists, differing interpretations, and the spirit of the times. We happen to be living in a fairly laissez faire era. (It’s almost certain that Disney would’ve been blocked by buying 20th Century-Fox by pre-2017 DOJs.)

If Disney and Apple’s merger somehow snuck past regulars, it’s likely that both would need to sell off certain assets to make it happen. (For example, antitrust regulators may suggest that combining Apple’s “walled garden” of apps with Disney’s media assets would unfairly eliminate competition by defaulting to newsfeeds or advertisements for Disney-owned news sources, giving ABC an unfair advantage.) Whether Disney or Apple would even want to make the slimming-down moves needed to appease regulators is separate from the question of if they could.

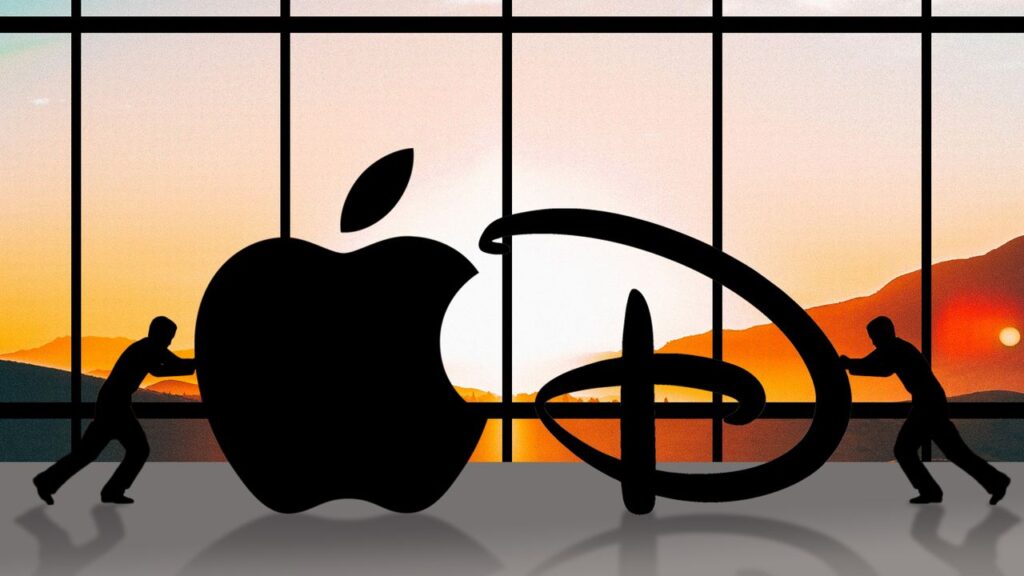

2. Apple might not be interested

While Iger can speculate in his book that he and Jobs might’ve eventually come to agree on a merger, he doesn’t suggest that either party ever said a word about it. And of course, Jobs himself isn’t around to comment.

So for all the frenzy that the idea might earn, and for all that Apple could technically afford to buy Disney if it wanted to, the truth is that Apple might not be interested in acquiring this very big, very beloved, but very messy company with dozens and dozens of business segments – most of which are entirely foreign to the streamlined, retail-oriented, and tech/design-focused Apple.

Of particular debate is the theme park division. Though incredibly profitable and certainly a jewel in Disney’s crown, many fans online have wondered aloud why on Earth Apple would want to get involved in the operations of theme parks? Fans have already spun up possible alternatives; perhaps “Disney Parks & Resorts” could be spun-off into an independent company to own and operate the properties, merely licensing Disney’s brands and characters from the new company. Of course, that’s just fan fiction – a hypothetical of a hypothetical of a hypothetical.

And in the unlikely even that Disney and Apple did merge, it’s equally likely that Apple would take to the parks like Comcast (a wholly unexpected owner for Universal Parks & Resorts) did for Universal Orlando. But it does go to show that for any number of reasons, it’s entirely possible that Apple has no interest in owning Disney, making this all a moot point.

3. Iger might be too proud

While some suggest that selling Disney to Apple would be a legacy-leaver for Iger, others have a very different opinion: that by “selling” Disney (even if it’s framed as a successful, even-sided “merger”), Iger would instead come across as a leader who couldn’t keep the company independent.

To that line of thinking, selling Disney to Apple is something of a failure; a staggering end to the company’s century-long history that would read like Iger is folding. And suddenly, just like “NBCUniversal: A Comcast Company” or “Paramount Pictures: A Division of ViacomCBS,” Disney would just be another company whose destiny isn’t really its own, entering into the world of corporate consolidation, spin-offs, segmenting, and what might be a century of being bought and sold between parent companies. And Iger – to whom legacy seems incredibly important – would be the start of it; the man who sold Disney.

No matter how much Disney might benefit from joining Apple or how much the move were spun as a win-win, cementing Disney within a larger ecosystem while it’s at the top of its game, the message would always be that Bob Iger sold the company. And that might not be a narrative he wants to touch with a ten foot pole…

Will they or won’t they?

So… will they or won’t they? This is Jim and Pam in the middle of season two of The Office, folks. Anything seems possible. The prospect of Disney and Apple combining forces is, for fans of either company, at once terrifying and dazzling; fascinating tabloid fodder for entertainment journalism; and weirdest of all, possible.

But is it likely? Right now, no one but Disney and Apple’s leadership know. Have discussions happened? Will they? Or are each company’s respective C-Suite executives baffled by the Internet’s obsession with the Internet’s imagined romance between these two immortal companies? We’ll keep our ear to the ground. In the meantime, what do you think the future holds for Disney and Apple? And will that future be together – either through a stock swap, a buy-out, or a balanced merger?