It’s one of the most anticipated data drops in all of theme park nerd-dom… Every year, the Themed Entertainment Association (TEA) partners with a consulting firm called AECOM to compile an annual report on the ups and downs of theme parks, waterparks, museums, and other “thematic” experiences from the year prior. (If you haven’t yet, check out our coverage of the significant takeaways from the 2022 Report here.)

This year’s result – the 2023 Global Attractions Attendance Report – is a fascinating document that theme park fans should dive into in depth. It’s filled with the highs and lows, global contexts, and stories that permeated theme park news in the year prior. But most importantly… it also contains a ranking and roll-up of the year’s theme park attendance.

To be clear, most theme park operators do not disclose their parks’ attendance, and even if they speak in broad generalities, totals, or percentages at investor calls, they almost never divulge specific attendance figures for specific parks… However, it’s known that many operators do work with AECOM to come up with fairly accurate figures since it’s in the best interest of their share price, financial disclosures, and year-upon-year narratives that their attendance be discussed vaguely, but honestly.

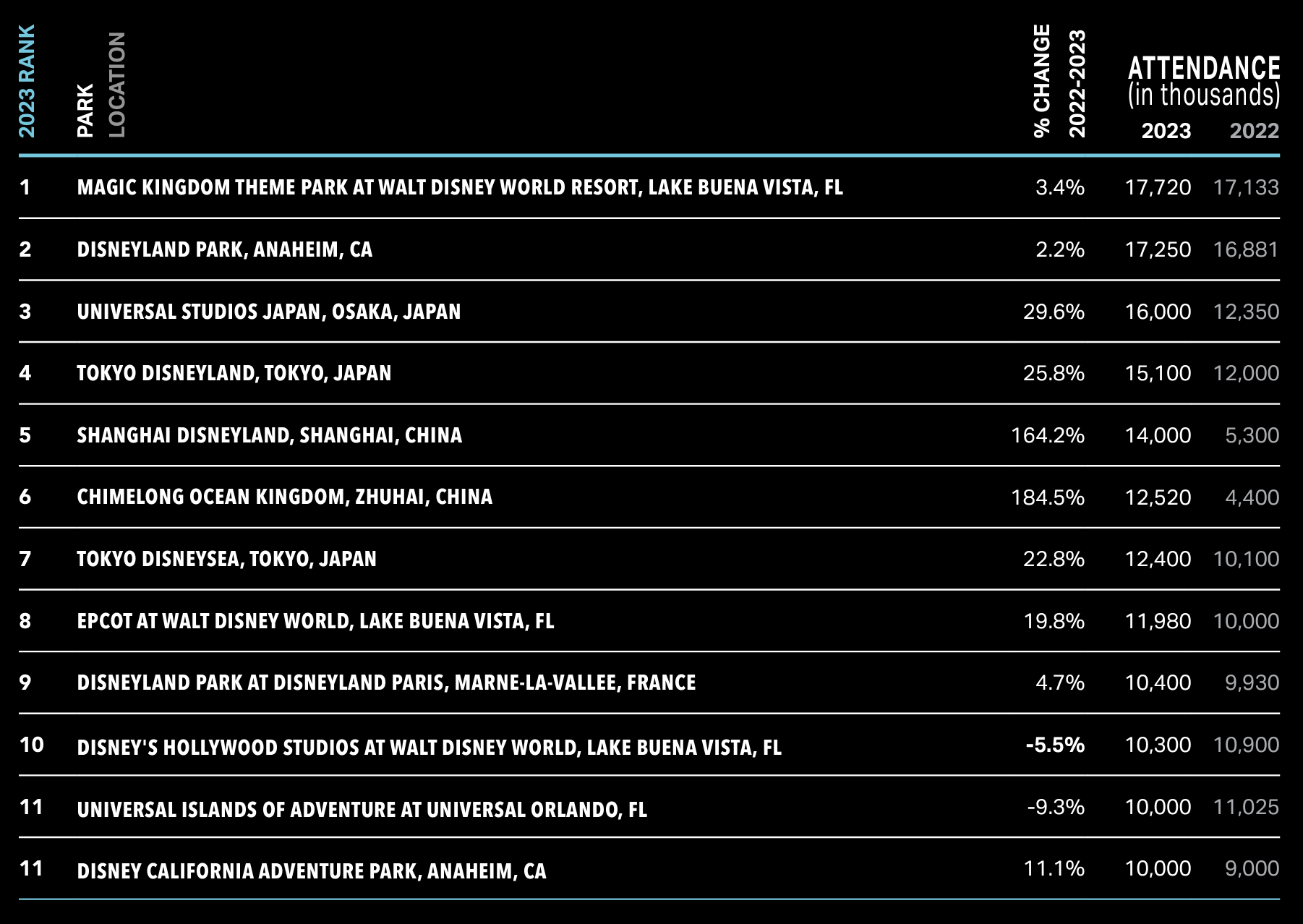

As far as industry observers are concerned, the Report’s August 2024 publication is as good as a lock on last year’s attendance numbers, providing an interesting analysis of increases, decreases, and a “mixed and modest” year of results. The top 12 parks globally include:

1. Magic Kingdom (17.7 million, +3.4%)

2. Disneyland Park (17.25 million, +2.2%)

3. Universal Studios Japan (16 million, +29.6%)

4. Tokyo Disneyland (15.1 million, +25.8%)

5. Shanghai Disneyland (14 million, +164.2%)

6. Chimelong Ocean Kingdom (12.5 million, +184.5%)

7. Tokyo DisneySea (12.4 million, +22.8%)

8. EPCOT (11.98 million, +19.4%)

9. Disneyland Paris (10.4 million, +4.7%)

10. Disney’s Hollywood Studios (10.3 million, –5.5%)

11. Universal Islands of Adventure (10 million, –9.3%)

12. Disney California Adventure (10 million, +11.1%)

13. Universal Studios Florida (9.75 million, –9.3%)

14. Universal Studios Hollywood (9.66 million, +15%)

As always, here are a few big picture highlights the data reveals.

1. Universal’s pre-Epic dip begins

This time last year, jaws around the industry dropped at the news that Universal’s theme parks had rocketed up the rankings, with Universal Studios Florida and Universal Islands of Adventure landing at number seven and number five respectively. The prospect that Islands of Adventure had beat out Hollywood Studios, EPCOT, and Animal Kingdom was a shock – and seemingly, a harbinger of a new era coinciding with Universal’s rise.

At least according to AECOM’s estimates, that momentum has hit a snag. Both Universal Orlando parks lost attendance to the tune of 9% – a pretty debilitating and worrisome loss. It also tracks with on-the-ground reports that tourism is widely down in Central Florida as the bubble of pent-up demand from the pandemic pops. (That makes it even stranger that Disney World reports across-the-board increases despite the anecdotal unlikeliness… Anyway.)

Comcast already lowered investors’ expectations around the parks at their quarterly earnings call in July 2024, and worse, prophesied that we should expect those losses to continue until 2025. They point to the imminent opening of a third theme park – Universal Epic Universe in 2025 – as the reason that guests are delaying trips. Hopefully.

In any case, this certainly isn’t the trajectory Universal hoped it would be on ahead of Epic Universe’s opening… especially with industry insiders suggesting that if Universal over-expands, their new theme park could actually cannibalize their lowest performer in Orlando (Universal Studios Florida) and see guests replace a day rather than add one.

2. EPCOT’s “reimagining” succeeded

EPCOT may “always be in a state of becoming,” but according to Disney CEO Bob Iger, the opening of the “Celebration Gardens” in late 2023 definitively serves as the end of the park’s latest round of reinvention. Announced in 2017, the pandemic-strangled reboot of the park didn’t exactly get across the finish line with all of its promised projects in-tact, but you can’t argue with the reported results. Disney claims that EPCOT’s attendance increased by an incredibly impressive 19.4% – simplistically, every guest Universal lost between 2022 and 2023 is a guest EPCOT gained – about 2 million.

Granted, part of that increase is because the park’s new “Lightning Lane Single Pass” headliner, Guardians of the Galaxy: Cosmic Rewind, opened halfway through 2022, making 2023 the first full year of the ride’s operation and its inevitable effect on attendance. But by the numbers, EPCOT’s increase was substantial and undeniable.

Of course, speaking of cannibalization, in the continuous ebb-and-flow of Disney World’s non-Castle parks, the two million visitor increase at EPCOT coincides with a million guest loss between Hollywood Studios and Animal Kingdom – and like clockwork, both had substantial expansions planned at the 2024 D23 Expo. (Currently, Animal Kingdom resides at the somewhat disquieting position of being number seventeen on the list. Yikes.)